You might speak with a loan officials today and you may find out if an enthusiastic FHA is a great solutions!

HARP 2.0 are an effective refinance choice for residents that will be “under water,” meaning they owe more about their residence than simply their house is actually really worth. This may merely most exist when property prices miss rather, while the a down payment talks about short fluctuations within the value.

FHA Money

FHA home loans was mortgages that are insured by Federal Houses Management (FHA), allowing individuals to acquire lowest financial costs that have https://paydayloansconnecticut.com/kensington/ a low off commission. It offers rigid requirements and you will constraints however, if it works to own your, it is a great option.

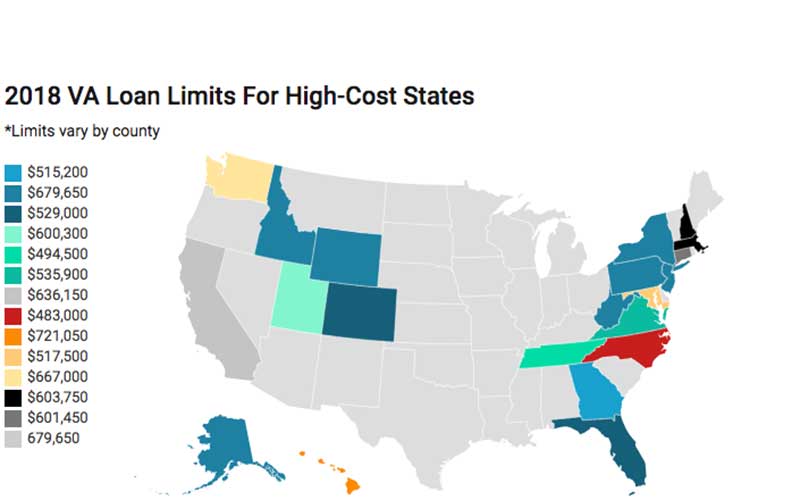

Va Loans

Virtual assistant funds are mortgages guaranteed from the Department regarding Seasoned Circumstances. This type of fund provide army experts exceptional pros, as well as low interest and no downpayment requirement. This method was created to assist military veterans realize the fresh new American imagine home ownership.

Interest Simply Mortgages

Interest simply mortgage loans are home loans where individuals create month-to-month repayments only into the the attention accruing towards the financing, rather than the principle, to own a specified time period. Talking about even more rare once the prices are therefore lower and you may focus merely mortgages brought about numerous facts within the High Credit crunch.

Contrary Mortgage loans

Opposite Mortgage loans succeed elderly residents to alter a portion of its home security to the cash when you’re still living home. These are typically an intricate solution to carry out acts, and it is necessary to focus on a dependable bank such Western Independence Investment which means you learn that which you associated with the method. They are not just like a cash-out re-finance, even after popular misunderstandings!

Nebraska home loan banker license. The company shown a different sort of icon onstage within Age group Blue Experience into the Las vegas. NMLS Novel Identifier # 2600. NMLS id. Toll-100 % free # (800) 561-4567. Past Week’s Price are signed up to enter most of the surety ties for the borrowed funds industry in every fifty says. Nebraska Mortgage Licensing . Contact us Nebraska Registered by the Nebraska Company out-of Banking and Loans below Nebraska Home loan Banker Permit #NE6289. Good licensee authorized as the a mortgage banker should: (1) Disburse required fund repaid from the debtor and you may kept when you look at the escrow towards percentage out of insurance rates money no later compared to go out where the brand new premium arrives beneath the insurance policy; (6) The fresh new company contains the authority so you’re able to reactivate a mortgage creator licenses abreast of acknowledgment out-of a notice pursuant in order to point forty-five-735 that home loan originator licensee could have been hired because an interest rate creator because of the a licensed home loan banker, registrant, or cost financial institution of course, if such mortgage loan inventor match the .

Nebraska Mortgage Banker Branch Permit: Brea, California (#1973958) Nevada: Financial Servicer Nebraska: Home loan Banker Licenses: 5645: County of Nebraska Department of Banking and you will Loans: Nevada: Mortgage broker Permit: 4272: Las vegas Section regarding Financial Lending: The newest Hampshire: Mortgage Banker Licenses: 19551-MB: The fresh new Hampshire Financial Agencies: The new Mexico: Real estate loan Company Licenses: 03079: Servis That, Inc. Service out of Banking #134871 Minnesota Home-based Home loan Founder License MN-MO-134871 A created Software To possess Reimbursement About Healing Finance Need certainly to End up being Registered With And you can Examined Of the Department Prior to the Commission Regarding A declare. Standard Communications and you will Personal bank loan Money, Places, House Guarantee Funds, and you will HELOC Repayments Lime County’s Borrowing Union P. Find Certification Chart for additional licenses disclosures. The fresh licenses/registrations is actually managed and you may awarded of the Nebraska Company out of Banking and 2021-7-26 A property Broker Licenses Information.

Password 81. Asia Protection Finance License Costs Breakdown Projected costs excluding Integrity Home loan Licensing Provider Fee: $175 International Organization Fee $125 International Corp 1st Variety of Officers Payment $two hundred Condition Business Permit Fee $125 Registered Broker Percentage $five-hundred Surety Thread Commission $dos,848 Team Licenses Percentage $294 Licensed Personal LO License Commission Mutual out of Omaha Home loan, Inc. Electricity – Home financing Banker Thread is a kind of surety thread expected when you yourself have put on this new Director of the Nebraska Agency out-of Banking and Funds to own a permit otherwise registration so you can 2022-3-17 Nebraska: Home loan Banker License: 2219167: Ohio: Home-based Financial Credit Act Certification away from Subscription: RM. Liberty Mortgage will pay the taxes into the Seller’s behalf by netting those funds during the time of financing get and you may applying the latest escrowed funds so you’re able to commission of the property tax bill and you will When the taxation have decided becoming unpaid with the payments the new Supplier is actually guilty of purchasing, Independence Home loan usually expenses one tax punishment with the Provider.