Property guarantee personal line of credit is good revolving type of borrowing applied for up against the guarantee in your home

Rotating means it may be utilized any time, and you may paid when with no penalty. As a good HELOC was secured together with your residence’s collateral, the brand new rates are much lower than standard personal lines of credit.

You could acquire regarding and you can pay down the line of credit anytime, if you dont discuss their limit. Your own borrowing limit is determined by just how much security you possess in your home you truly need to have over 20% equity to track down good HELOC. The exact amount you could acquire is related to some thing titled your loan-to-value ratio, or LTV. Your own LTV is the amount your debt in your home against. the worth of the home if you were to promote today. Instance, should you have home financing of $250 see,100000 leftover towards a property value $five hundred,one hundred thousand these days, your LTV might possibly be 50%. If you decide to up coming take-out a great HELOC to possess $fifty,000 thereon property, you’d owe $300,000 as well as your LTV would be sixty%. The newest max LTV to have an excellent HELOC was 80%, therefore, the full amount of any funds toward assets (along with first-mortgage, second mortgage, and you can HELOC) can not be over 80% of your value joint. For the a $five hundred,100000 family, the newest maximum LTV out-of 80% mode you could borrow to $400,one hundred thousand.

A good HELOC was a good rotating financing, if you find yourself the second home loan try a keen instalment financing. An effective rotating loan may be used almost like a credit card (in reality, certain HELOCs include a cards one allows you to spend money regarding line), when you find yourself an instalment financing is far more such a home loan.

HELOC

You really have a threshold that you could borrow around within when. When you initially submit an application for a revolving product, your use is actually 0%. You can submit an application for a good rotating device well before you intend to utilize or need it, and also as a lot of time because harmony are $0 that you don’t payanything.

Using a good HELOC

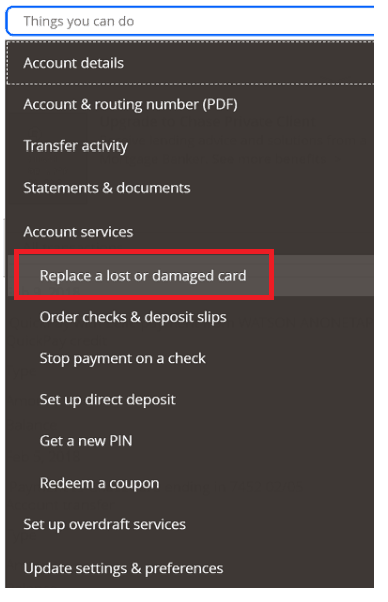

When you need money, you are taking money from this new line. Dependent on your own financial, discover a couple of ways you can access the cash. Certain include cards that can be used such as for instance playing cards at the retailers, but anybody else simply allow you to transfer funds on the internet about financial net webpage. Anyway, you’ll start accruing desire just regarding the go out you utilize it.

Repaying an effective HELOC

HELOCs was desire-only affairs. Meaning you are not required to pay the primary monthly, only the desire. Your monthly obligations could well be much lower than simply that loan that need desire and you will prominent payments, but there’s zero set agenda for payment. For many who never ever lower the balance, possible pay attract fees permanently. You could potentially pay the full harmony people HELOC any kind of time day no penalty. The sooner you pay it off, the latest shorter possible spend during the attract over the life of the latest financing.

Household Equity Financing

When taking away a property collateral loan, your use a specific amount and you can hope to repay they over a-flat period of time. If the funding is released, you will be using one hundred% of your financing.

Using a house Security Mortgage

You have made an entire amount of the mortgage in a lump contribution. Its your responsibility to expend it wisely. Many lenders enables you to remove property equity mortgage to possess practically any excuse just be sure it is a good one.

Paying down property Equity Mortgage

You’ve got a-flat payment per month having a home collateral financing that you have to spend each month. According to their financial, your ount near the top of their monthly payment to settle they quicker. However, spending it off completely can result in a punishment.

To get an effective HELOC, you’re going to have to ensure you get your family really worth appraised. The cost vary with respect to the sorts of appraisal requisite, that can feel waived completely by your bank.Concurrently, you are going to need to spend a bona fide property attorney to join up the new HELOC towards assets. Here’s a listing of some common HELOC setup fees:

Assessment

A house appraisal will state the lender how much cash your home may be worth. Since the amount you could potentially obtain is actually personally linked with your equity, it is an important step-in taking a HELOC. Usual rates: $150 – $250

Judge will cost you

Joining brand new HELOC into the assets requires a bona fide estate attorney. Administration prices are precisely what the financial charge you to definitely settings an effective HELOC, not what the newest attorneys demands to register the property. Usual pricing: $150 – $two hundred

Name lookup

A concept look verifies your the fresh rightful proprietor out of a house. That have identity theft & fraud growing when you look at the Canada, it is necessary that your particular bank confirms you possess the property you’re seeking put that loan so you’re able to. Common costs: $250 -$five hundred

Laziness charge

The lender can charge you inactivity charge if not obtain against the HELOC for some time. Common rates: may vary by bank

Discharge costs

After you don’t you want your HELOC, or if you offer your residence, you will need to discharge the new HELOC from the assets. This is simply for example registering the brand new HELOC, however in contrary. Common pricing: $two hundred – $300