How do Signature loans Really works? [And also the Most readily useful and you may Poor Making use of Them]

We possibly may receive payment regarding services and products stated in this story, however the feedback is the author’s ownpensation may impression in which offers appear. We have perhaps not included most of the readily available affairs or even offers. Find out about how we make money and you can the article principles.

Based on recent studies from Experian, 22% regarding Western people has actually an unsecured loan and you can hold the average harmony out of $16,458 personal installment loans Phoenix IL. People use these loans to pay for unanticipated costs, combine personal debt, finance house home improvements, plus.

Unsecured loans might be an appealing solution along with their liberty and you may seemingly low interest. However, they might not the best solution for all, making it necessary to know the way personal loans performs before you can signal your own term into dotted line.

- How do signature loans work?

- 8 how do you use a personal bank loan

- 4 worst the way you use a personal loan

- What things to think because you search for unsecured loans

- Alternatives so you’re able to unsecured loans

- The bottom line

How do unsecured loans really works?

Signature loans are used for just about any goal unless of course the mortgage explicitly says the way you have to use the loans. He or she is a variety of cost financing, and that means you acquire an appartment amount of money and pay-off the loan over a predetermined amount of payments, otherwise installments. they are generally speaking a personal bank loan, and thus they’re not supported by security, just like your household otherwise automobile.

You can apply for signature loans during the finance companies, borrowing unions, and online loan providers. How much money you could acquire differs from lender to help you financial, but since you check around, you will probably find financing also provides somewhere within $step one,five hundred and you will $one hundred,000.

Having an unsecured personal loan, the mortgage count and apr your qualify for are tend to based on their borrowing character, with your earnings, credit history, and you can credit history, one of other variables. Typically, the better your credit rating, the greater amount of beneficial the interest rate you likely will discover.

Unsecured loans generally have repaired interest levels, for example the rate continues to be the exact same over the existence of loan. In case it is predictability you are just after, a predetermined-rate mortgage could be the way to go. By contrast, variable-speed fund possess lower rates, nevertheless the pricing will change for the field. Variable-rates signature loans try less frequent than repaired-rates possibilities.

8 how can i fool around with a personal bank loan

People fool around with signature loans for lots of factors, but like most financial device, it is better to make use of him or her only when it can make feel. And, definitely are able to afford brand new payment per month every month before you progress.

Whenever you are wanting to know if a consumer loan makes sense for your problem, here are a few of the most extremely common reasons why you should rating a unsecured loan:

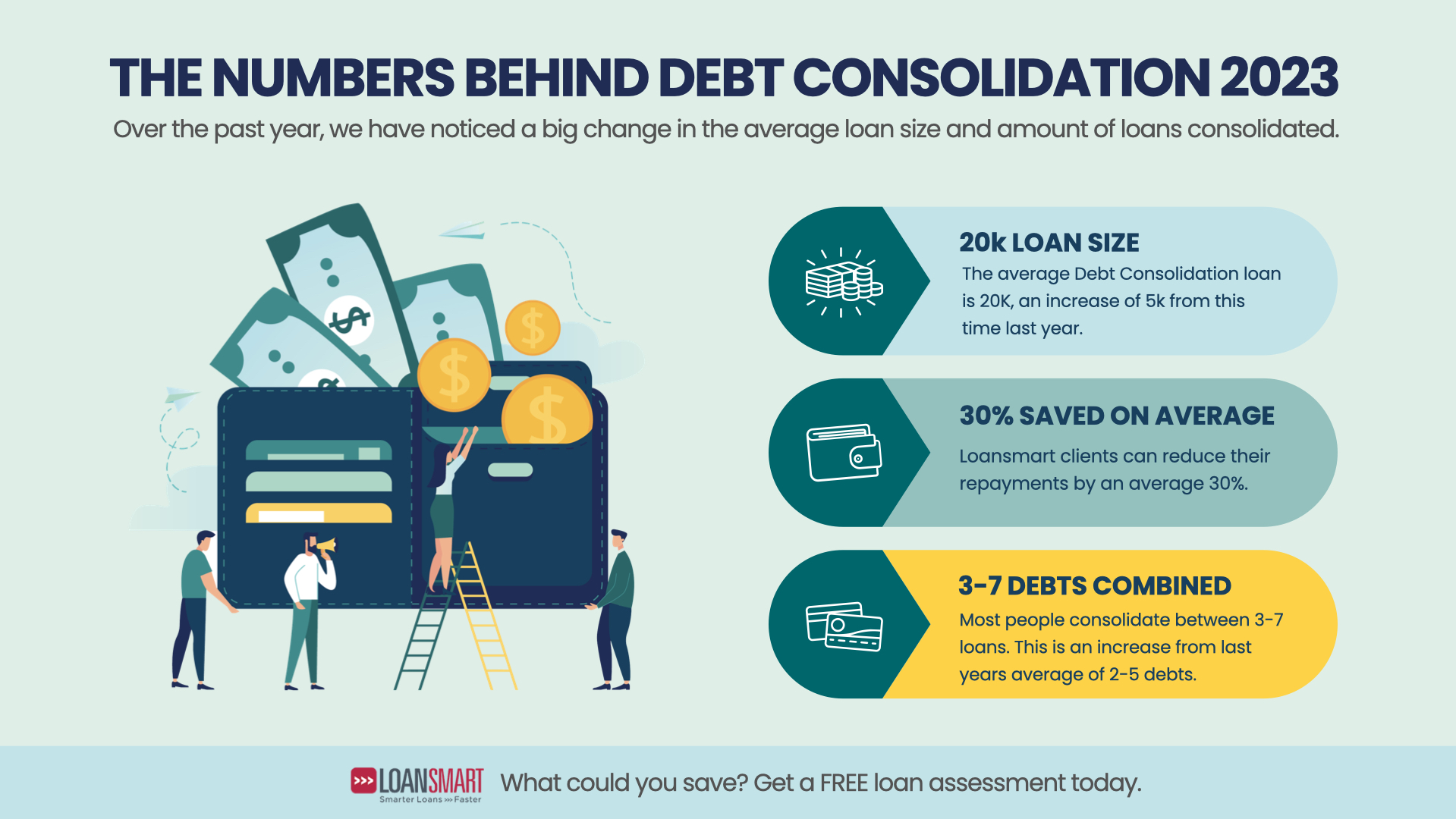

step 1. Debt consolidation

For those who have best that you higher level borrowing from the bank, personal loans could will let you spend less if you are paying out of higher interest obligations having a reduced-desire loan. Such as, you may use the loan proceeds to pay off higher-attract credit card debt and then pay back your straight down-attract personal bank loan over the years. Which have all the way down focus can cost you, you might be capable of getting off debt quicker.

dos. Home renovations

Signature loans you will definitely offer property owners ways to modify their homes because of the since the cost of do-it-yourself programs. Of many users like personal loans over domestic guarantee finance or household collateral lines of credit because they typically don’t need that make use of your family as the equity.

3. Emergency costs

A consumer loan may potentially bring enjoy recovery whenever lifetime leaves you a monetary curveball. For example, while you are abruptly faced with unforeseen medical expense otherwise funeral costs, an unsecured loan may help if you don’t have adequate readily available fund in your crisis fund. Once again, just make sure you can afford new monthly loan percentage very you’re not struggling financially.