Category: what cash in advance

One of the most very first criterion to have a financial would be the fact it is bad

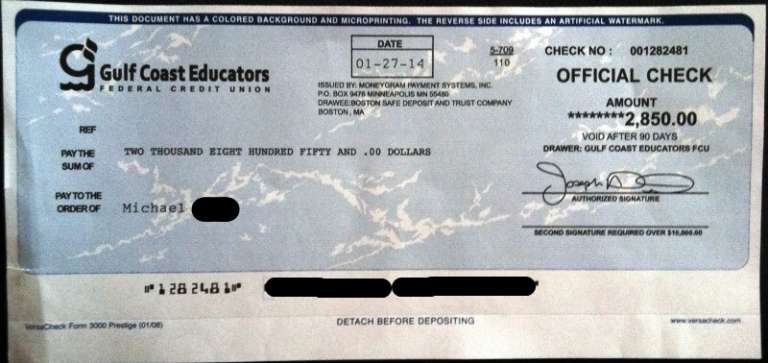

While you are looking forward to the latest letter, We prevented playing with repeated autopayments and simply performed arranged repayments in which We told Ally explicitly things to pay in the place of according to their ebill system to figure it out.

Anytime I asked them for energy regarding lawyer inside early in the day 6 weeks it facsimile me personally a web page plus it reveal it

After that, when the page showed up, new Ally associate only told you this new percentage is actually never ever scheduled. She told you that they had no list of any fee ever-being scheduled up to Months after my Friend Help Speak. You will find display images about day of the fresh new talk indicating the fresh new billpay web site advising me personally which i had a continual payment planned with the membership 5 days up until the due date – a screen attempt from Months in advance of they do say I finally scheduled a fees. In addition possess a screen shot out-of my personal Ally Assist Cam where in actuality the Ally associate said he spotted the fresh percentage was booked is here by due date – another type of display screen test of Months ahead of it is said At long last scheduled a cost in which they know a fees are arranged but mysteriously maybe not sent. Continue reading “One of the most very first criterion to have a financial would be the fact it is bad”

Internal revenue service Explains Brand new Taxation Laws Failed to Destroy House Collateral Focus Deduction

Specialized Personal Accountant **Certified Economic CoordinatorMaster regarding Rules into the TaxationEvery Taxation Condition features a solution

According to -thirty-two, there are issues for which desire to your family guarantee finance is still allowable in Income tax Incisions and you will Work Act out-of 2017. The brand new Internal revenue service has now explained one to taxpayers can frequently nevertheless subtract interest toward a property equity mortgage, domestic collateral credit line (HELOC) otherwise next home loan, it doesn’t matter what the borrowed funds are labelled [stress extra].

Before Taxation Incisions and you will Jobs Work regarding 2017, a great taxpayer who itemized deductions, could deduct mortgage desire to your acquisition of a qualified home for the an amount as much as $step 1,000,000, as well as a supplementary $100,000 off family security financial obligation. Acquisition financial obligation is known as a loan regularly pick, create or dramatically help the household, leaving various other home loan personal debt given that family security personal debt.

Within the Tax Cuts and you can Perform Work of 2017, the latest deduction to possess desire for the house guarantee indebtedness is frozen having taxation ages beginning once . What of one’s brand new taxation rules left of many tax positives and you may taxpayers worried you to definitely attention paid off into family security personal debt may no expanded end up being deductible around one issues.

The new Internal revenue service informed one to, pursuant on Income tax Cuts and Services Operate from 2017, the newest deduction to possess focus repaid with the home equity funds and you can contours away from credit is actually frozen of 2018 up until 2026, except if they are utilized to shop for, create otherwise substantially increase the taxpayer’s house one protects the borrowed funds. Continue reading “Internal revenue service Explains Brand new Taxation Laws Failed to Destroy House Collateral Focus Deduction”

What is actually a beneficial Virtual assistant Certificate off Qualifications for Va Lenders?

You could potentially subscribe the brand new Veterans Affairs’ of several work with applications to have honorably-released solution people, like the Virtual assistant Mortgage. It’s the most affordable and versatile mortgage solution to your the business months, if for example the productive-obligation or a veteran.

Nevertheless cannot simply walk into a home loan lender’s place of work and you can boast of being army: you have got to prove it. Dressed in the uniform or blinking your own army ID will never be adequate for the Virtual assistant to provide financing. You desire a file named a certificate regarding Qualification (COE), plus fulfilling particular solution standards.

That it document will act as the newest evidence of services need so you’re able to initiate their travel to your homeownership that have a great Virtual assistant Financial. Find out more to know about a certificate from Qualifications and just how to track down one to.

What’s an excellent COE?

The new Certificate away from Qualifications is actually a part regarding Pros Activities file you to definitely demonstrates certified army service. This file including demonstrates to you your own Virtual assistant Financing Entitlement password and other requirements, such as whether you need to afford the Virtual assistant funding commission otherwise maybe not.

Of numerous prefer to understand this file at your fingertips ahead of interested in a home or meeting with a lender. However they doesn’t want it initial in addition they may help you receive they by at the rear of you from the techniques.

It is possible to initiate the home lookup and mortgage journey before acquiring your COE when you’re sure of the eligibility. Continue reading “What is actually a beneficial Virtual assistant Certificate off Qualifications for Va Lenders?”