You will find reasons lenders reduce quantity of guarantee that can be used getting a property security personal line of credit

HELOC Benefits & Disadvantages

Prior to deciding whether or not to score a beneficial HELOC, you should consider the advantages and you can downsides. Some tips about what to adopt.

Benefits of using a HELOC

- A beneficial HELOC allows you to generally obtain what you would like during the committed you really need it

- ?HELOCs usually have straight down interest levels and higher terms than borrowing from the bank notes, but also the liberty that is included with rotating borrowing from the bank

- Using good HELOC to repay student loan personal debt could possibly get rescue you money depending on your role

- ?HELOCs try an easy way to deal with unanticipated expenditures, such as for example family repairs

- ?You can safer an excellent HELOC now, and then you are certain to get use of money afterwards for those who you would like them unconditionally

- You’ll find taxation benefits of HELOCs-including, some of the focus paid towards the a great HELOC is generally taxation-allowable provided the bucks is being utilized for domestic renovations or fixes

Cons of employing a beneficial HELOC

- ?If you are using good HELOC, you may be with your household once the equity. If you were to default to your loan, this may imply shedding your property

- ?HELOCs suggest you’re very likely to gather even more financial obligation than you you prefer

- There’s also a feeling of uncertainty with HELOCs because if the worth of your house transform, you’ve probably a decrease in the degree of borrowing from the bank offered to you personally. The lending company might freeze the fresh available borrowing entirely

For folks who consider the pros and you will downsides and eventually decide good HELOC is the correct one for you, be sure to compare lenders, as they often are different as to what they supply, such as for example which have advertising also offers.

Option Resource Choices to HELOCs

Otherwise want to use a line of credit, you can also believe almost every other household collateral resource solutions, such as family equity loans otherwise household collateral investments.

One another alternatives enables you to make use of the security you produced in your house in order to secure a lump-share fee used yet not you want.

A property guarantee loan is much more closely pertaining to a good HELOC than just a house security funding. These types of finance essentially https://paydayloanflorida.net/old-miakka/ come with repaired prices and fees attacks between four and you may thirty years. Individuals build repaired monthly premiums for the duration of the new cost several months to settle the borrowed funds.

A house collateral financial support, on the other hand, is significantly different. Normally, this is for home owners who are not qualified to receive traditional family equity investment. If you find yourself your property usually nevertheless serve as collateral, there are not any monthly installments. Alternatively, residents receive a swelling-sum fee in exchange for a percentage of the domestic guarantee. The fresh financial support organization will share on the really love or decline of your property in the name. Usually, you will be necessary to create you to definitely payment to repay the latest financing. This can be done which have dollars, compliment of a mortgage refinance, otherwise property profit.

The brand new lender’s HELOC product is known as Yards&T CHOICEquity, and it is stated while the a loan to help with unanticipated expenses or household fixes-whether or not domestic collateral financing can also be used with other purposes too.

- Interest rates: BB&T happens to be advertising adjustable introductory pricing only 3.99% getting 6 months . The newest basic rates is secured having 12 months having a primary mark of $fifteen,one hundred thousand or more during the closure. In the event the advertisements rate ends, pricing try reported only 5.24% .

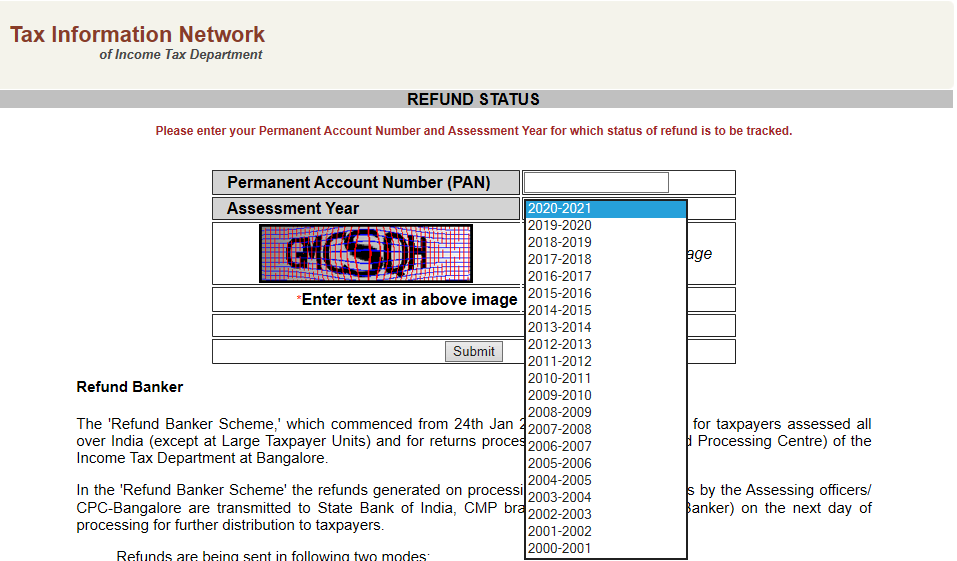

Extremely HELOC loan providers tend to legs the degree of borrowing they supply towards a specific part of the mortgage-to-value proportion. The newest percentage can often be from around 80% to ninety%. If for example the financial inside specific analogy would provide a house guarantee personal line of credit for as much as 90%, brand new homeowner carry out then have access to $180,000. It is ninety% of guarantee they have in their home.